Why Your Business Needs Cyber Insurance

When it comes to cyber insurance, there are two types of businesses, those that have been hacked and those that will be. The internet has made business easier, but it has also increased the risks. No organization is immune to cyber attacks, so cyber insurance is non-negotiable in today’s business landscape.

Here are some of the reasons for investing in cyber insurance:

Cyber Threats Are Invisible

When undertaking insurance for any of your valuables, the policies cover actions that are likely to occur. For example, when you have car insurance, the insurer is taking on a responsibility that should you get into an accident or should your car get stolen, they will cover the repair or replacement costs.

Of course, you don’t plan to have an accident, no one does. However, accidents occur daily, and you are protecting yourself against any eventualities.

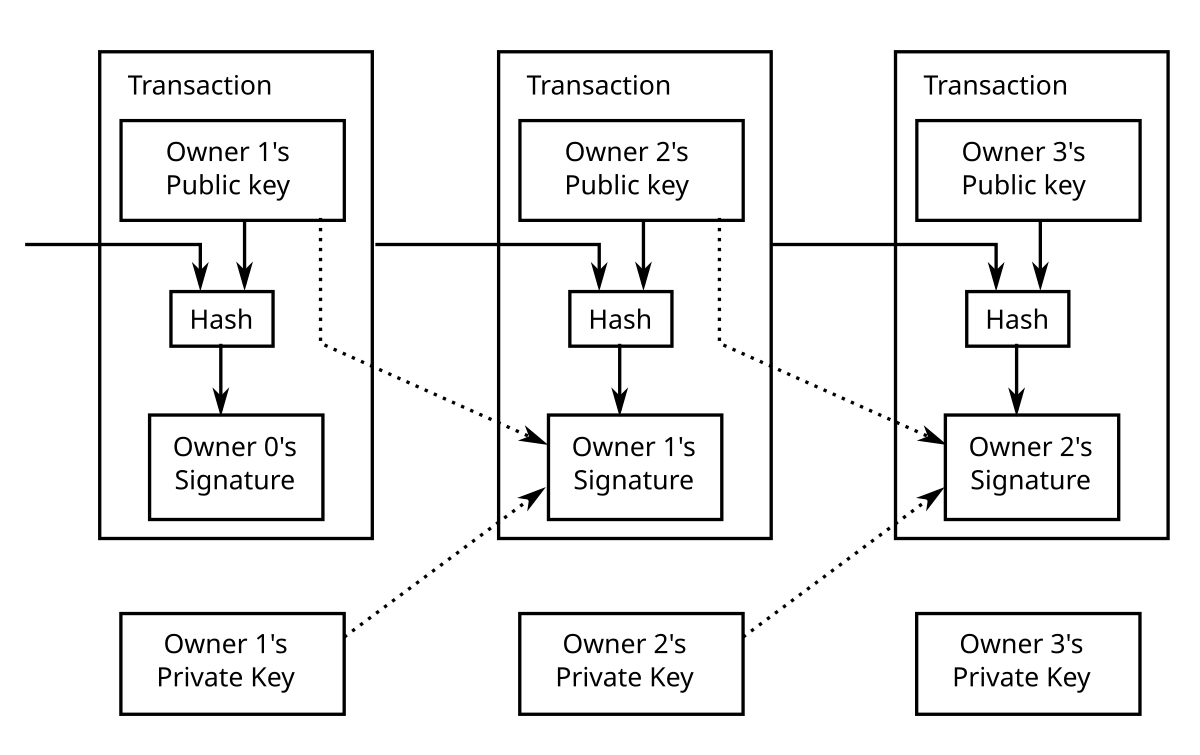

Cyber insurance is not any different. Every time you start your computer or feed in customer data in your system, you are exposing your business to threats. These are unavoidable activities, and hackers are always looking for ways to get into your system and access this data.

Unfortunately, no business can say for sure where the threat will come from so that they can safeguard specific areas. Cyber attackers are continuously coming up with new strategies to “break into” computer systems. There is no standard format for how the attack will come.

The only way to protect your business is to set up barriers in your system and protect your business using cyber insurance.

You’ll Benefit From Forensic IT Experts

Now that more companies are offering cyber insurance coverage, they have forensic experts who will help analyze your systems and advise on ways to boost security before an incident. A data breach is an expensive affair, not just for businesses, but insurers as well.

Insurance companies will help you take measures to reduce your vulnerability. They will also be at hand to analyze threats and resolve a potential breach quickly and effectively. Most business people are usually at a loss when their systems are hacked.

They don’t know where to start because the damage can be so massive, and can quickly get out of control. It is not just the business that is at risk, but stolen consumer data can destroy other people’s lives. It takes companies a long time to recover from a data breach.

Fortunately, cyber insurance companies use specialists to;

- Hunt down the breach.

- Identify vulnerable points.

- Restore security.

- Fight lawsuits.

- Handle public relations in case the breach attracts media attention.

Costs Of A Data Breach Can Bankrupt A Business

Cyber threats come in different forms. It may be data theft, network interruptions, privacy violations, or even the destruction of a company’s software or hardware. These threats also come from anywhere.

It could be a business competitor, hackers seeking data for ransomware, or even state players from other governments. Cyber espionage gives assailants information that puts them at an advantage. These invisible enemies can cause your business so much damage that if you were to do it on your own, you may never recover.

Many companies in Singapore don’t have cyber insurance because they cannot afford it. The average annual premium depends on the level of coverage. The more comprehensive the cover, the more protected you will be, and the more you will pay.

However, the cost of obtaining cyber insurance appears negligible if you consider what a breach will cost your business.

Depending on the cyber risk protection you get for your business, the insurer will cover;

- Ransom payment if the hackers hijack your system and data.

- Costs of monitoring client data. It could be a stolen credit card or ID information.

- Restoration costs, especially if hardware and software were destroyed.

- Business interruption costs.

- Expenses the business incurs to operate in an alternative area until the business premises are ready for use again.

- Legal defense fees.

- Compensation payments.

- Costs of notifying clients of the breach.

- Costs of hiring a public relations firm to perform damage control.

Many businesses, especially small and medium-sized enterprises, cannot survive handling these costs simultaneously.

Insurance companies appreciate the costs of cyber insurance are high. This is why they are heavily invested in training and monitoring business systems before, during, and after an attack. Undoubtedly, your business will be in a safer space when you have cyber insurance. Contact a reputable commercial insurance provider like Allegiance for a Cyber Insurance Quote today.